texas estate tax exemption

Property tax in Texas is locally assessed and locally admin-istered. How much you save with the home stead exemption depends on the exemption amounts and tax levels adopted by your city county and other local governments.

Texas Estate Tax Everything You Need To Know Smartasset

There is no state property tax.

. Texas has no income taxes but it levies a franchise tax of 0375 on wholesalers and retailers. Death taxes consisting of inheritance and estate taxes are also non-existent. Dont leave your 500K legacy to the government.

Only the CADs may make changes to your property records mailing addresses etc. In 2022 the unified credit will increase to 12060000. There is no state property tax.

EXEMPTIONS FOR ATVS AND OFF-ROAD VEHICLES. Ad Get free estate planning strategies. Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

The local option exemption cannot be less than 5000. B Land owned by the Permanent University Fund is taxable for county purposes. Texas Estate Planning and Cryptocurrency July 10 2022.

The primary residence of the applicant. Once you obtain an over-65 or disabled exemption your. The sixth-most populous county in Texas Collin County also has the 15th-highest property taxes.

The end product is tangible personal property. All residence homestead owners are allowed a 40000 residence homestead exemption from their homes value for school district taxes. Other Property Tax Exemptions in Texas.

Property taxes pay for schools roads police and firemen. If the county grants an. Tax Code Section 1113 b requires school districts to provide a 25000 exemption on a residence homestead and Tax Code Section 1113 n allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a propertys appraised value.

Applications for property tax exemptions are filed with the appraisal district in which the property is located. A Except as provided by Subsections b and c of this section property owned by this state or a political subdivision of this state is exempt from taxation if the property is used for public purposes. 12000 from the propertys value.

For example the Plano Independent School District levies a 132 property tax rate and the Frisco Independent School District levies a 131 property tax rate. If you own a ranch and you are age 65 or older you qualify for this exemption as long as you live in a house on the property. Through nearly 20 years of law practice15 of which have been focused on the representation of tax-exempt organizationsthis writer has been involved in numerous seemingly simpleand some cutting edgeapplications for exemption from Texas property taxes for religious organizations.

Appraisal district chief appraisers are solely responsible for determining whether or. This is the APPRAISAL phase. While the increase itself is notable what may be more important is the fact that the credit is currently expected to be cut in half for 2026.

It is also important to remember that Texass threshold is higher than. Tax Code 151318a2A. Totally blind in one.

Property tax in Texas is a locally assessed and locally administered tax. Seniors older than 65 or disabled residents. Under Texas law minerals like lignite are considered real property until they are extracted or removed from the earth.

Eligible seniors will get a 10000 exemption for school district property taxes. SENIOR TAX EXEMPTION. A disabled veteran may also qualify for an exemption of 12000 of the assessed value of the property if the veteran is age 65 or older with a disability rating of at least 10 percent.

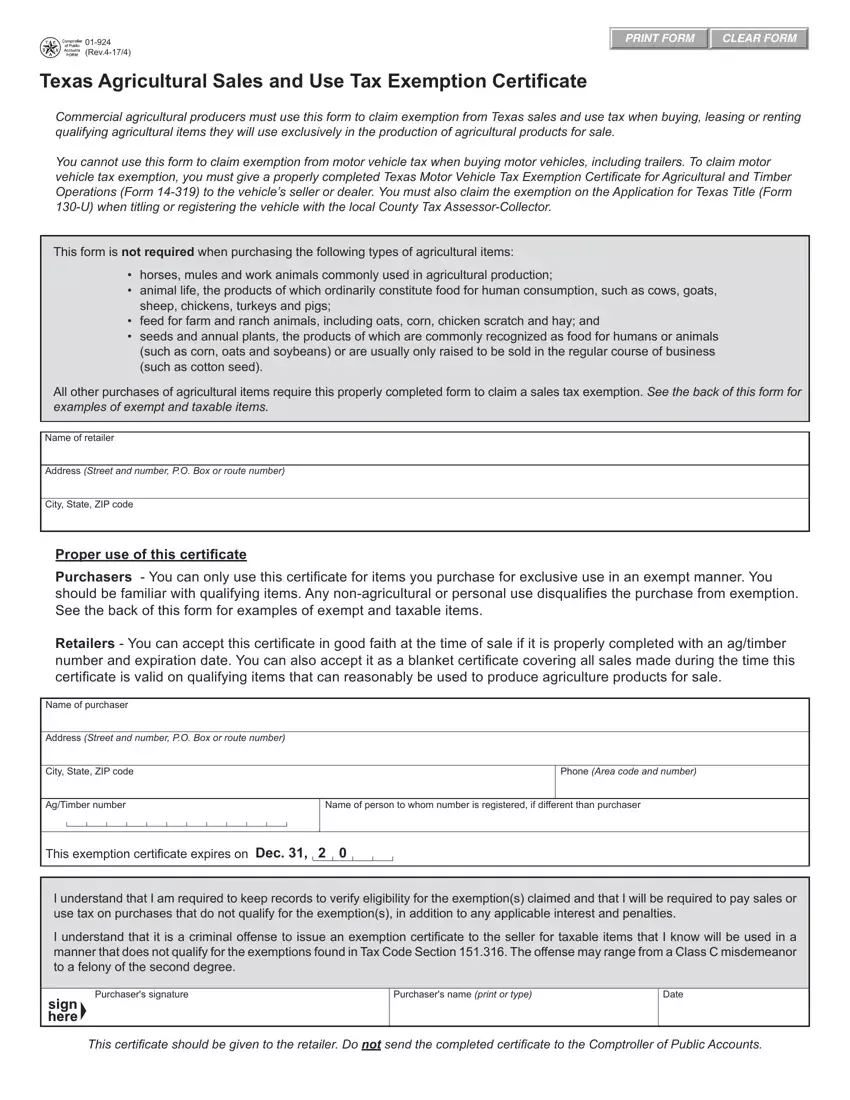

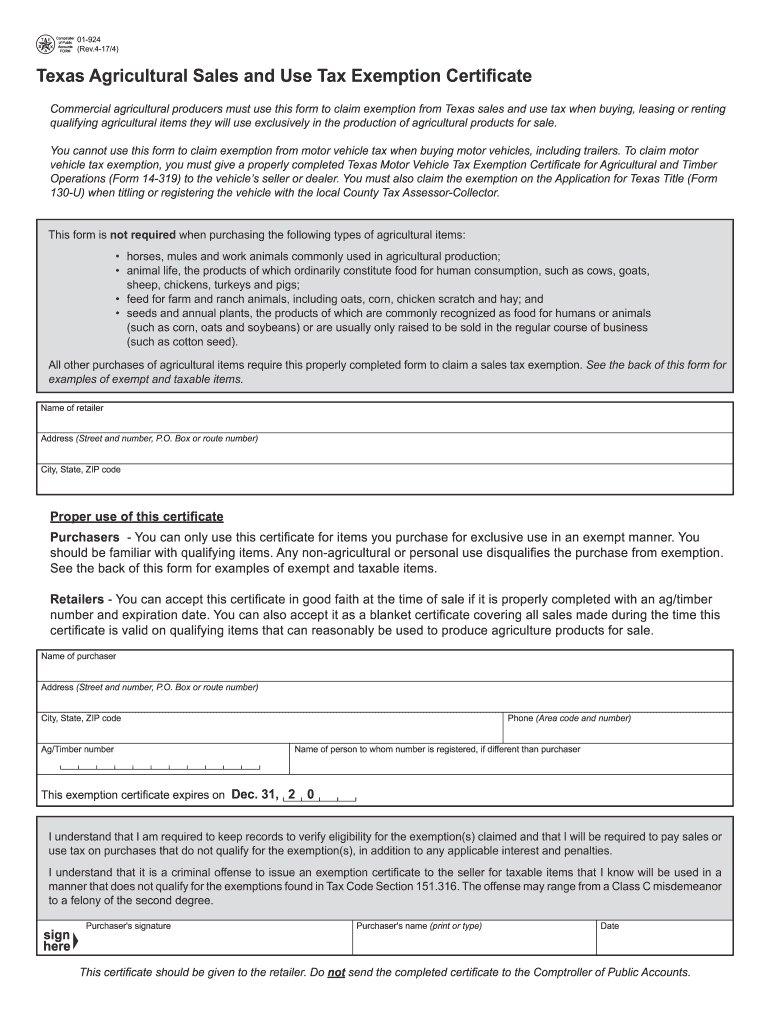

This is driven largely by the high rates used to fund local school districts. Ad Download Or Email Form 01-924 More Fillable Forms Register and Subscribe Now. In Texas the federal estate tax limits apply.

Property tax brings in the most money of all taxes available to local taxing units. Property Tax Basics in Texas. If a county collects a special tax for farm-to-market roads or flood control a residence homestead owner is allowed a 3000 exemption for this tax.

In 2018 the thresholds for a single persons Texas estate tax were estimated to be 58 million and 112 million for a married couple. This rate can go up to 075 for non-exempt businesses. Reduction to the Estate Tax Exemption.

CADs handle ownership exemption and value information. The exemption will be added to the existing 25000 homestead exemption. A homestead valued at 200000 with a 20 exemption 40000 means you pay property taxes as if your home were valued at 160000.

Property Tax Exemptions 1. According to Tax Code Section 1127 you may qualify for a Texas property tax exemption if you have a solar or wind-powered energy device installed on your property. If you are a Texas resident with an estate to protect then do not hesitate to contact the.

This exemption carries over to spouses of deceased property owners as long as the property owner was at least 65 and the spouse is at least 55. In the past year there were proposals to reduce the estate tax exemptionmeaning lowering the amount after which individuals will need to pay a tax on their estate. The general deadline for filing an exemption application is before May 1.

Notably the statute does not require that the raw materials used as inputs to make the end product constitute tangible personal property. 2022 Lifetime Estate and Gift Tax Exemption. Property taxes in Texas are based on the January 1 market value of your property as determined by the county appraisal district CAD.

Any estate that exceeds these thresholds is subject to the federal estate-tax of 40. Texas repealed its inheritance tax in 2015 and has no estate taxes either. Although they are not common there are a few other Texas property tax exemptions that might apply to your situation.

Property tax brings in the most money of all taxes available to local governments to pay for schools roads police and firemen emergency response services libraries parks and other services provided by local. Exemptions from property tax require applications in most circumstances. The Breakdown of Taxes in Texas.

Texas Inheritance And Estate Taxes Ibekwe Law

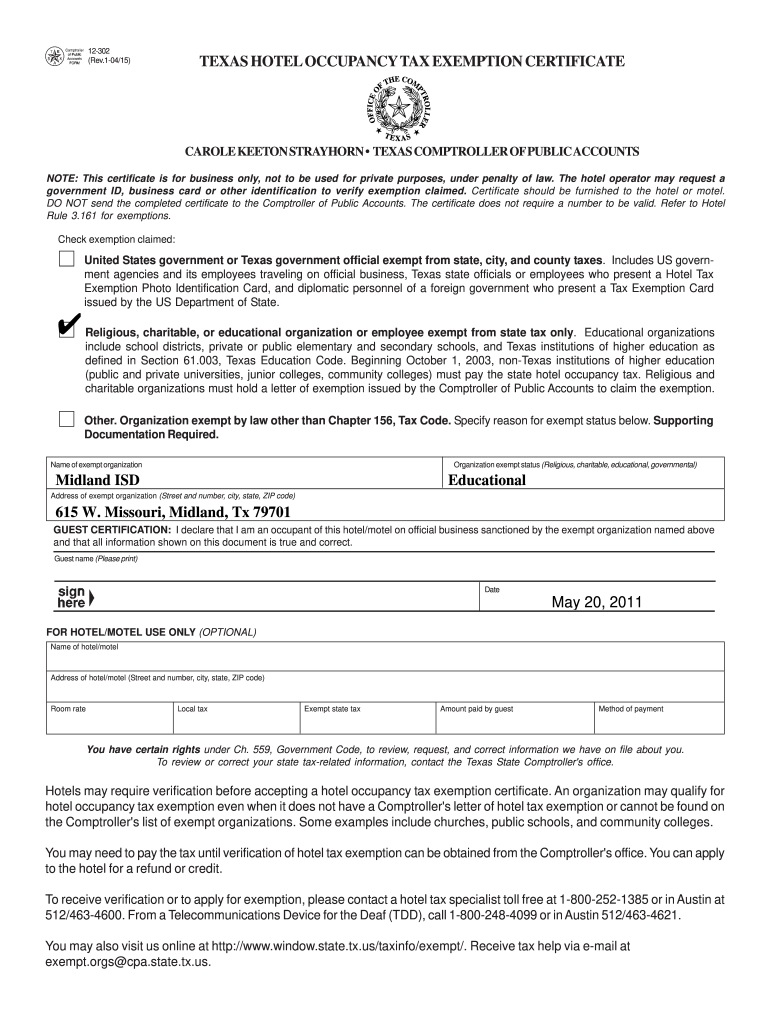

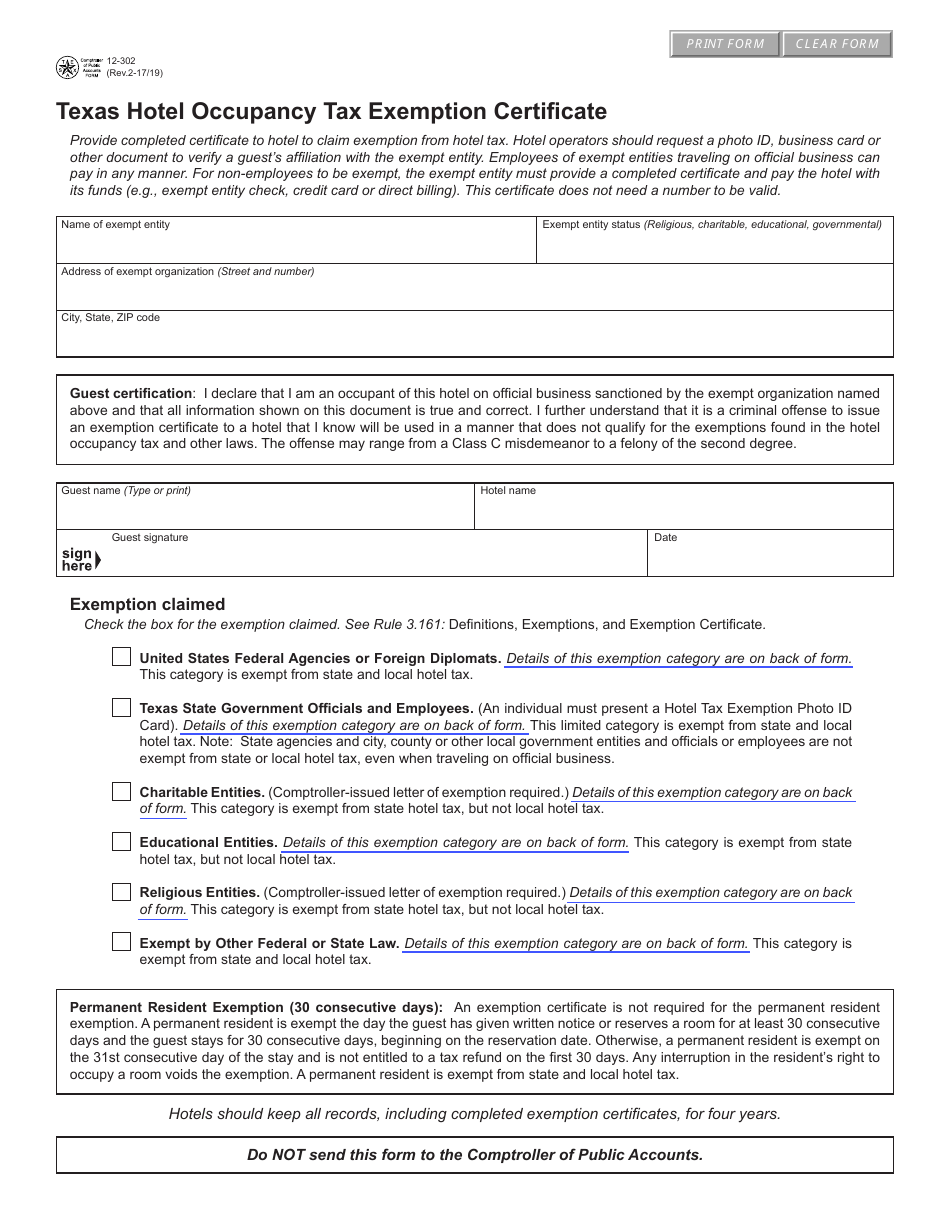

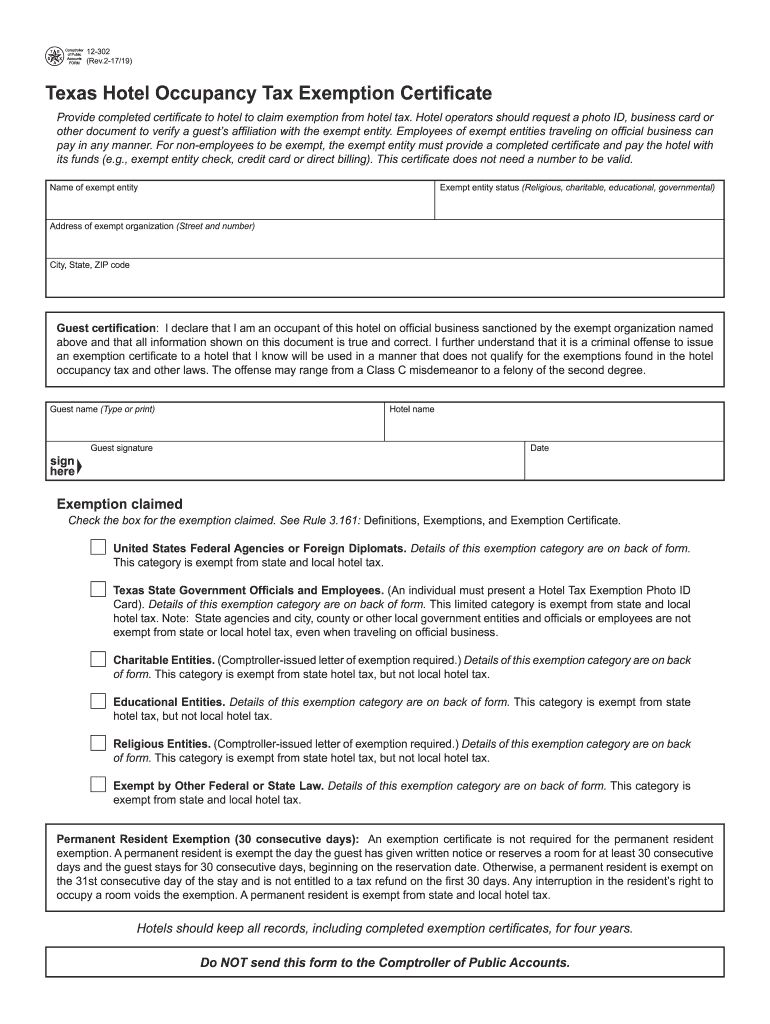

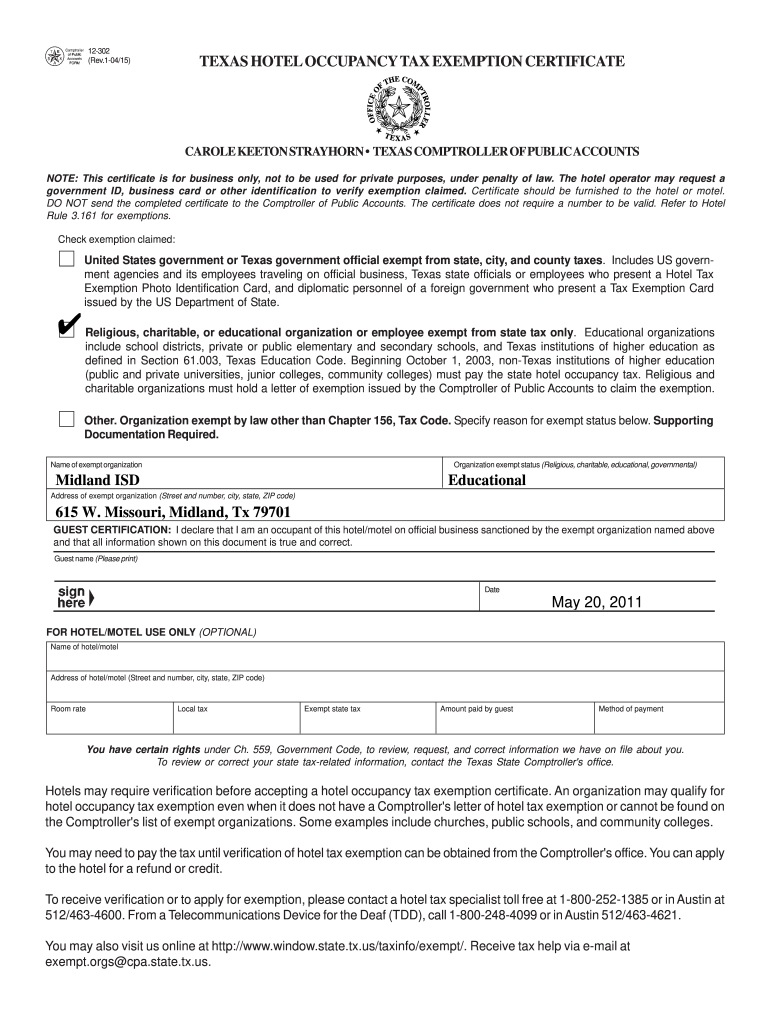

Form 12 302 Download Fillable Pdf Or Fill Online Hotel Occupancy Tax Exemption Certificate Texas Templateroller

Qualifying Trusts For Property Tax Homestead Exemption Sprouse Shrader Smith

Tx Comptroller 01 315 1991 2022 Fill Out Tax Template Online Us Legal Forms

Tx Comptroller 01 924 2017 2022 Fill Out Tax Template Online Us Legal Forms

Tx Comptroller 12 302 2017 2022 Fill Out Tax Template Online Us Legal Forms

Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

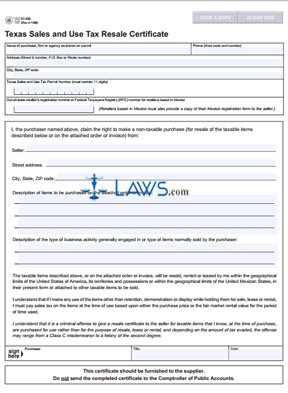

Free Form 01 339 Texas Sales And Use Tax Exemption Certification Free Legal Forms Laws Com

Texas Tax Exempt Certificate Fill And Sign Printable Template Online Us Legal Forms

Texas Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Over 65 Property Tax Exemption In Texas

Texas Homestead Tax Exemption Cedar Park Texas Living

Texas Estate Tax Everything You Need To Know Smartasset

Is There An Inheritance Tax In Texas

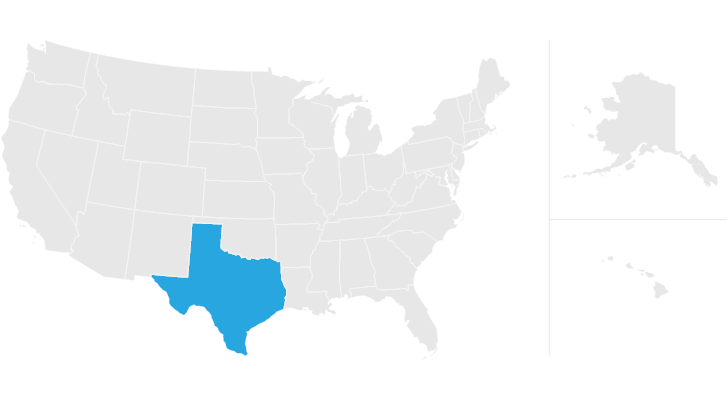

States With No Estate Tax Or Inheritance Tax Plan Where You Die

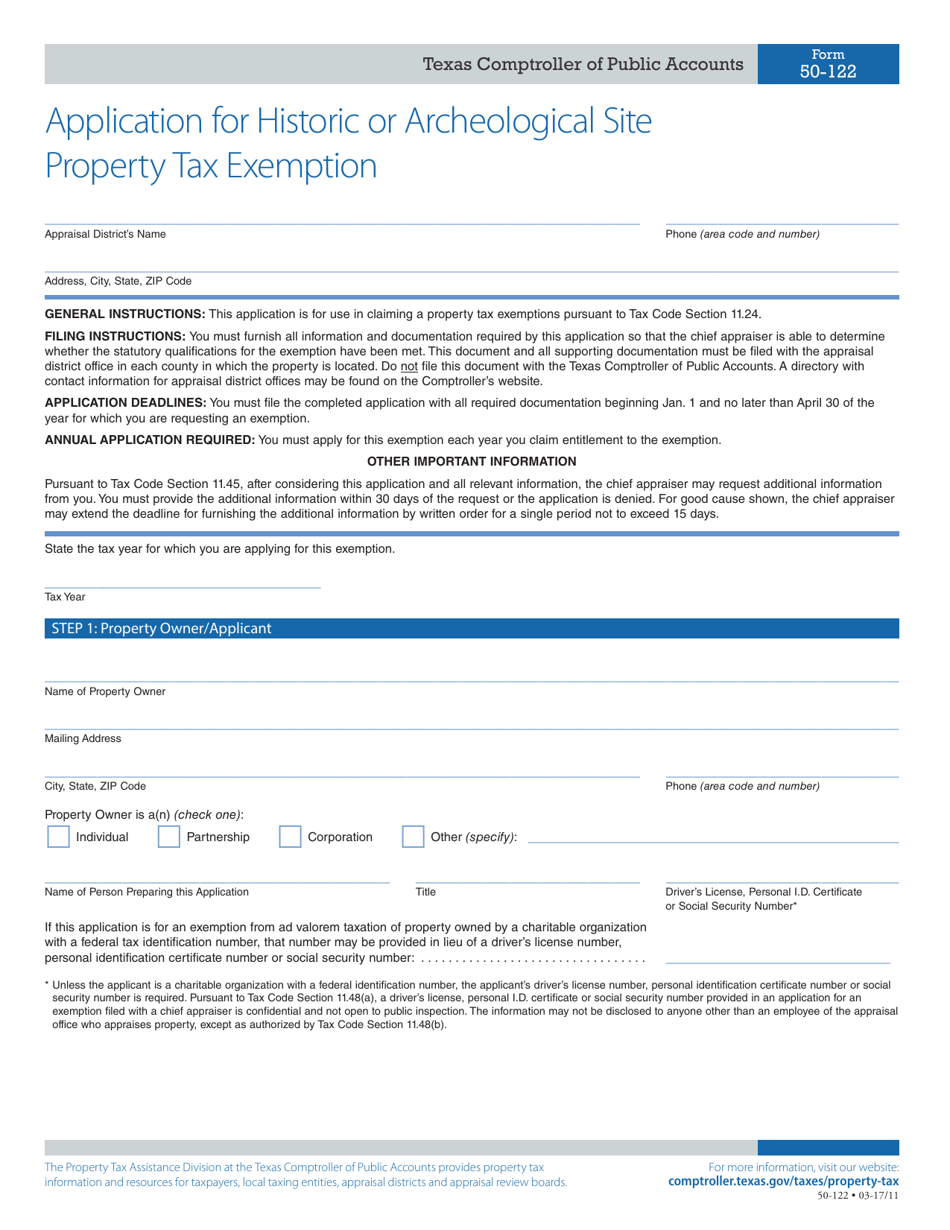

Form 50 122 Download Fillable Pdf Or Fill Online Application For Historic Or Archeological Site Property Tax Exemption Texas Templateroller